You (and only you) are responsible for the financial decisions that you make.

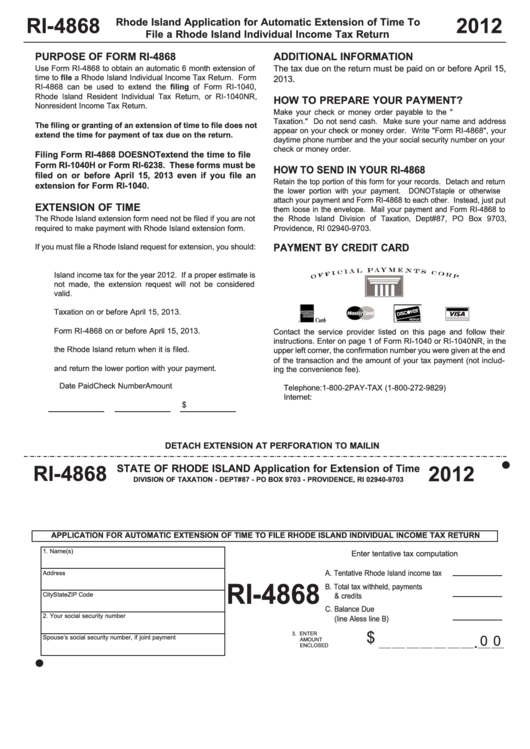

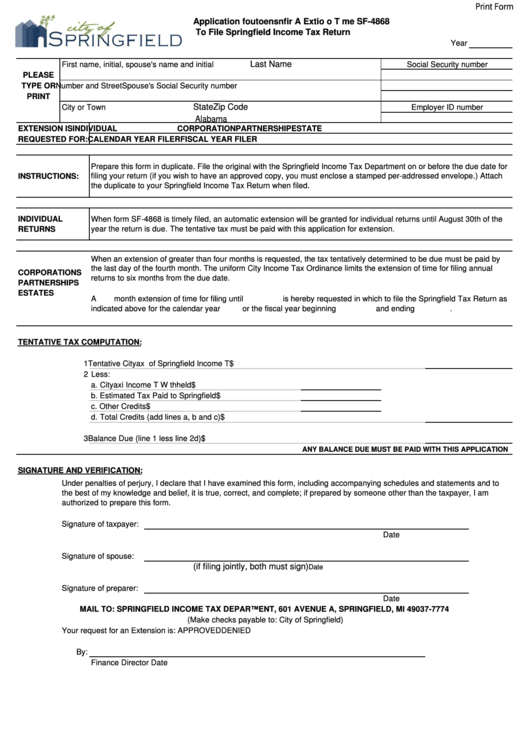

If the due date is a Satur-day, Sunday, or legal holiday, substitute the next regular workday. When to File This Form Form M-4868 is due on or before April 15, 2017, or on or before the origi-nal due date of the return for fiscal year filers. Please do your due diligence and research on the topic. Form M-4868 with 0 entered in line 7, you must do so electronically. Although the information is researched and vetted beforehand, it may not be up to date at the time of viewing. The ideas presented in this video are for entertainment purposes only. From filling out IRS Form 4868 to understanding the benefits of filing a tax extension, this video has everything you need to take care of your taxes this year!ĭISCLOSURE: We are not financial advisers.

We'll take you step-by-step through the process of filing a tax extension, and explain everything you need to know. If you're feeling stressed about your tax deadline, this video is for you. Are you feeling overwhelmed with all of the taxes you have to file this year? Don't worry, we've got you covered! In this video, we'll walk you through the steps necessary to file a tax extension, so you can have more time to prepare your taxes.

0 kommentar(er)

0 kommentar(er)